1 year of stonks

01/27/21

A year ago, I started an experiment. Knowing nothing about the stock market, I opened a Wealthsimple account and deposited $1000 to begin trading. The goal was to see what that balance will be in exactly a year. I believe that making real trades with real money would teach me more about the market than simply reading Investopedia articles. Learning was the primary objective, but if I happened to make a slight profit that would be pretty nice too.

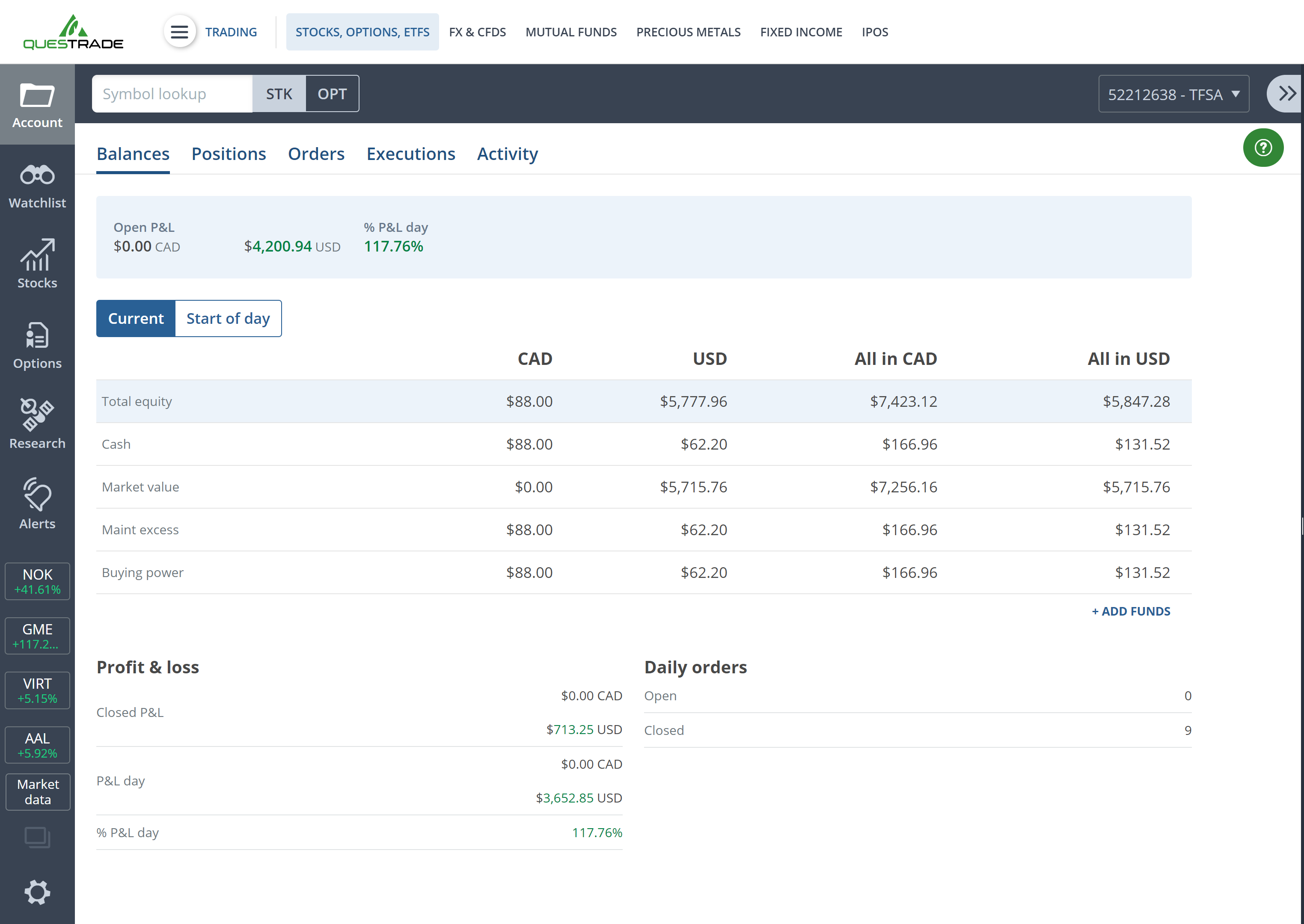

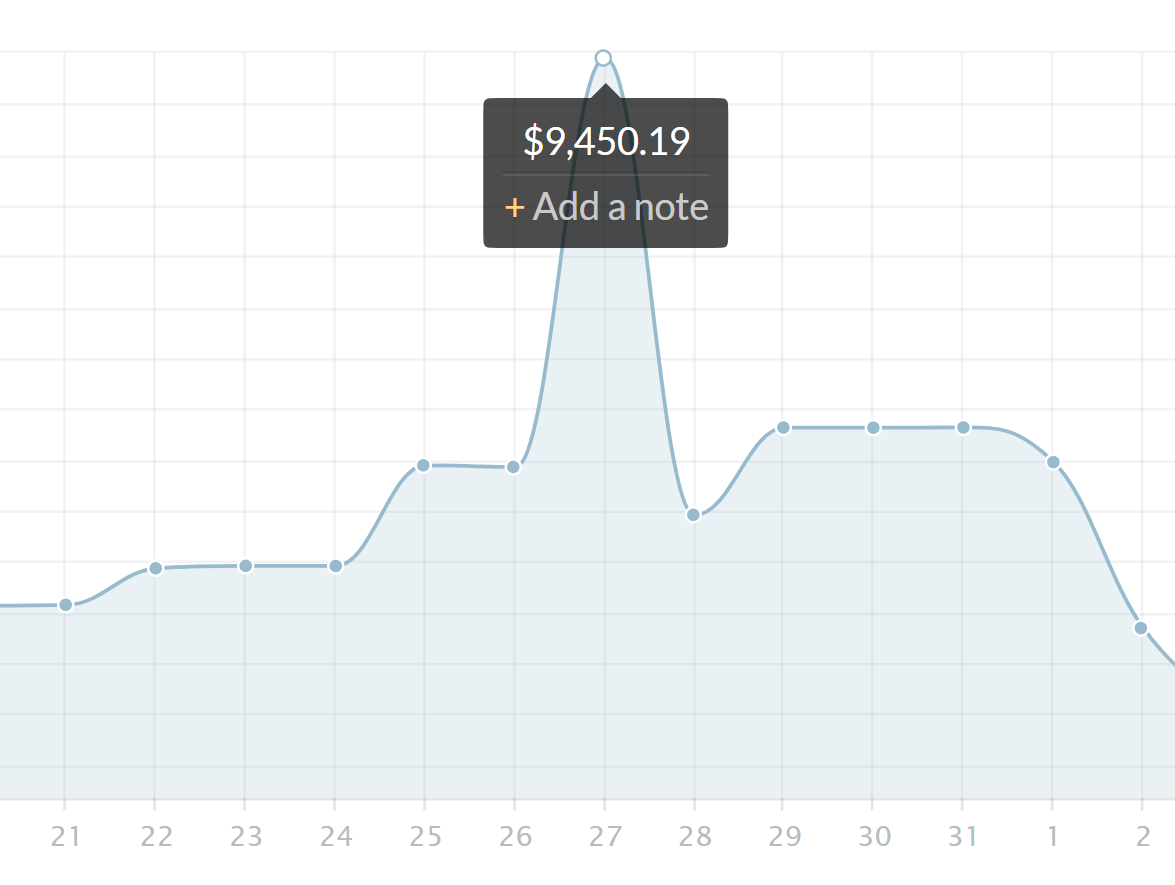

Fast forward a year, and that initial balance is now $5,847.28. Just today, my account gained a 117.76% profit, partly due to the unreal stock market trends spurred by r/wallstreetbets.

Although many others have had way more spectacular returns, I'm quite happy with how things turned out. Specifically, I learned a few lessons from my experience, which feel more tangible to me since I went through real trades to learn them. The goal of my writing this is to keep track for myself, but you may find some points useful for yourself.

Edit: My balance has fallen back to $1000 😂, a price that I paid to learn a very valuable lesson (covered below). I'm glad this happened, since I get to look at my trades from a bearish standpoint as well.

Disclaimer: The references below are an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

Some lessons on stonks

1. Think long term

Before making a purchase, I need to decide for myself timeframe I would prefer to trade on beforehand. How long am I okay with planning for?

When I first started, I did not invest with longer term market trends in mind. I overreacted based on short term spikes and dips, which weren't compatible with my trading behavior, which involved checking the stock market every month or so. A missed opportunity that taught me this lesson was when I decided not to purchase TSLA stock when it was at $400 in March. Instead of looking at the long term outlook, I waited to snag some shares whenever it would hit $250, which actually never happened. At the time, a $150 difference seemed significant. Now, the pre-split stock is valued at $3,456. A great opportunity was missed because I over-optimized for the short term.

Trading very short term is also more costly if you count in the commissions that your brokerage may make on a per-trade basis.

2. Some things are truly unpredictable

With all the Reddit fueled mania going on these days, I started to feel that the less I thought about a decision, the more profits I made. I learned the hard way that I just happened to be very lucky for some trades, and that there was absolutely no correlation between reckless investing and pure chance. We're currently in interesting times; the stock market is at an all-time high while the economy is in turmoil and record numbers of retail investors are entering the arena. The possibility of crazy things happening really is not that low.

Robinhood's abrupt trading ban on a few stocks is a prime example of how a the outlook of a stock could totally flip in just a few hours. I had call options on NOK, AMC and BB, summing up to over $3000 in my account. Things were looking good; these hot stocks were just hitting the mainstream media, and I was betting on FOMO (fear of missing out) that would push these stocks even higher. That sentiment totally disappeared the next day, when Robinhood effectively banned the buying of just these stocks, which instantly tanked them and wiped away my profits:

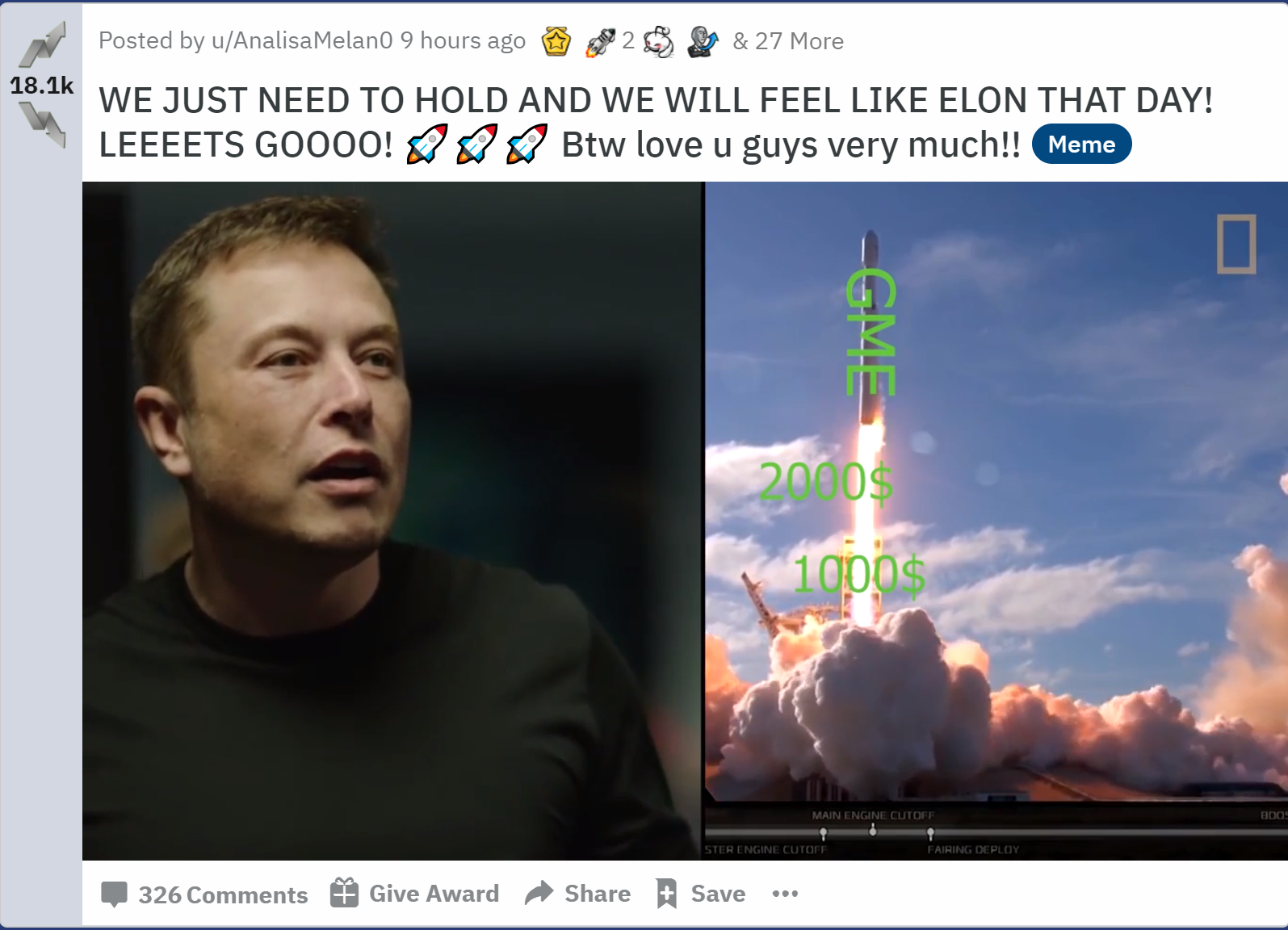

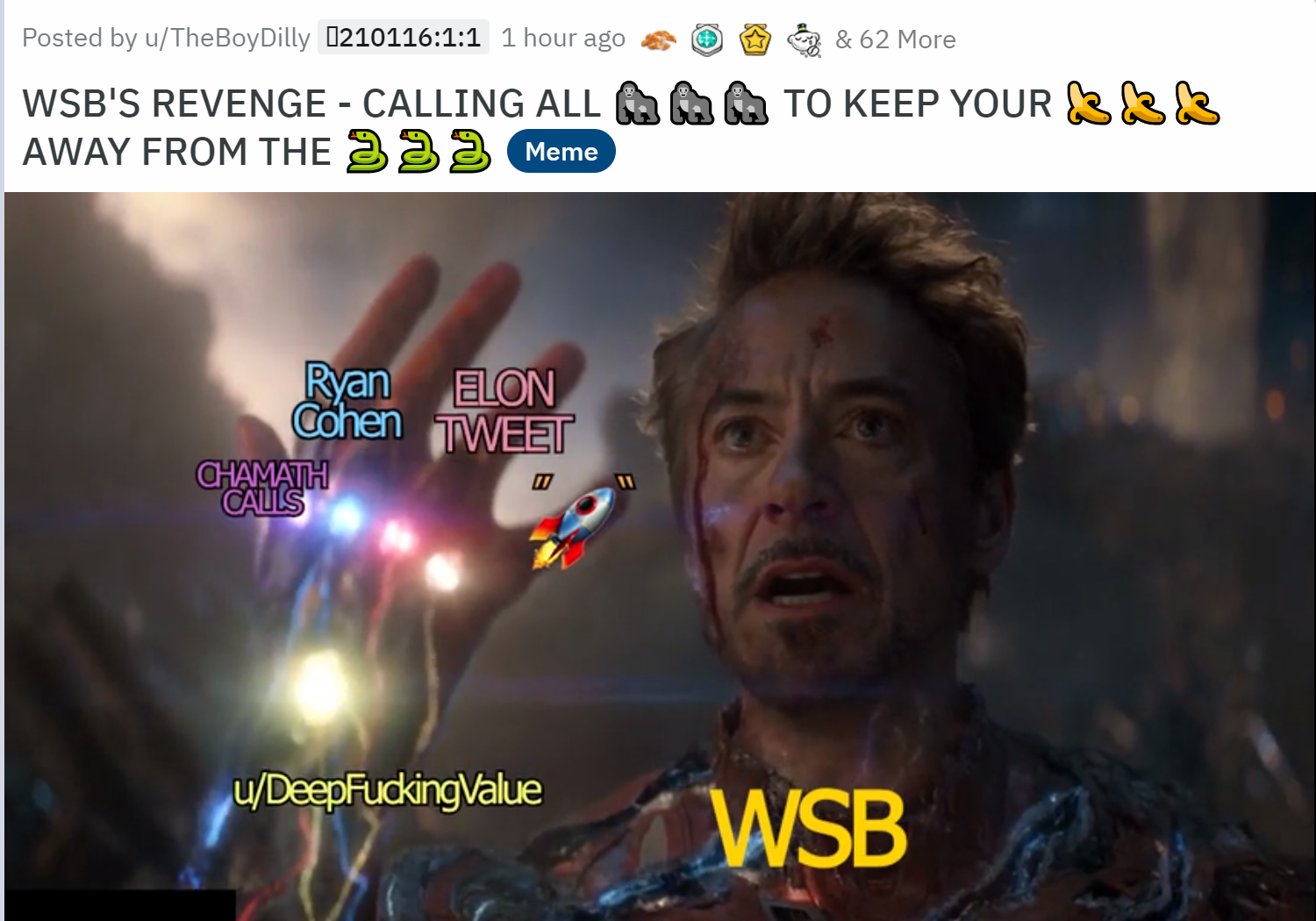

Basically I learned to not follow investment advice from this meme:

3. Stocks can always go higher (and lower)

It's nearly impossible to know whether a stock is at its peak or trough. Be okay with buying on slight markup and selling before it peaks. Look at the longer term performance of the stock (1 month - 1 year) to see whether there's real room for growth.

One situation that brought this lesson home was when I ironically bought GME on January 25 for $80. I had been following r/wallstreetbets for a while now, and this was just at the start of the entire spectacle that would make headlines. I was joking with friends that the stock would never go higher, so I threw in $80 just for the laughs. I thought I had already missed the run-up, but the stock had yet to go through the stratosphere:

4. The market is about group behavior, not finance

Traditional investment strategy uses well-refined strategies, but that's being challenged. Now, with the advent of commission free trading, we are seeing the emergence of a new player in the field: the retail investor. Apps like Robinhood and Wealthsimple have replaced Tiktok in the top charts, and the number of individual traders is skyrocketing. r/wallstreetbets has exploded from 1M to 7M+ users in the span of a month, and the stock market is getting more media attention than ever. The retail investor (like me) usually does not follow the time-old strategies used by institutional investors, which means that herd mentality now has some real impacts on the market. The use of memes and public investment advice actually influences the buying behavior of thousands of traders, many of whom are willing to bet on high risk, high reward ventures. In my opinion, I think that being able to predict whether people will buy can be just as useful as predicting the success of a company.

As part of my experiment, I decided at the beginning of this year to invest based on Reddit sentiment instead of fundamentals. So I bought about $300 worth of BB, AMC and NOK calls and stocks. This was by far my riskiest move, and it contributed to the biggest fluctuations in my account. Here, I made a fatal mistake; I started to become emotionally invested after watching the revolutionary movment on r/wallstreetbets. After making a $3700 gain, I didn't sell despite the red flags (high volatiliy, more than 50% of the account in high risk options), and ended up loosing it all and then some. This lesson could be summed up by a Warren Buffet quote:

I’ll tell you how to become rich: close all doors, beware when others are greedy and be greedy when others are afraid.

Sentiment can either reflect or contradict the current state of the market, and I'm sure that it provides many hints about what the market will be like in the future.

5. Trade proactively

My best trades happened as a result of acting ahead of the market. Most of the time, I had to buy/sell a security before a short term trend or long term projection hits the headlines. Since I didn't have the time to constantly stay on top of everything that is happening, I acted a lot on speculation. I was okay with betting 10% of my portfolio or less on short term trends that could either go flat or blow up.

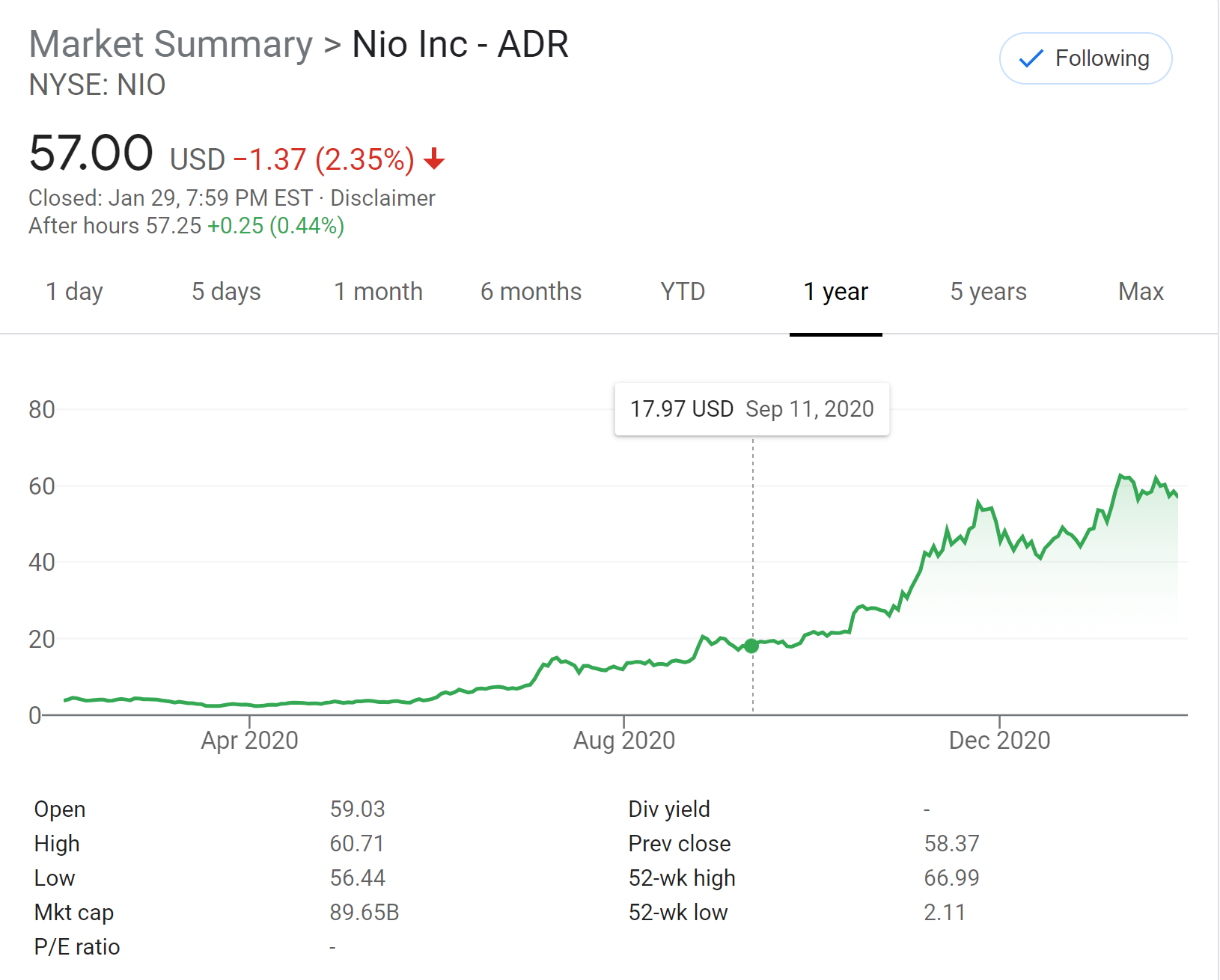

For example, I bought 15 shares of NIO at $17 in September, when the stock was at the highest it had ever been. I decided to hold despite fluctuations because I believed in the upside potential of the Chinese EV sector. Later, I sold it at $58. I'm also holding my GME shares, partly for the meme, but also because I really think we'll see some big upside in the near future.

6. Hedge your moves and keep risk in check

At the end of the day, you can always suffer heavy losses at any time. My strategy for mitigating this was by diversifying my portfolio, and staying aware of the risk in my account.

My preference is to have 60% of my portfolio in long term industry plays (for example, EV, AI, networking and microprocessing companies). 30% of my account is for mid term investments, which I think will have strong movement in the short to mid term. For the memes, the remaining 10% of my portfolio in high risk options (YOLO), which I would be totally okay with losing. Every month or so, I would rebalance my account to keep these proportions in check. For my YOLO plays, I usually should start to sell after they become more than 20% of my portfolio.

My fatal error this month was that I let my YOLO gains grow significantly (at one point reaching over 60% of my portfolio) without cashing out. Those high risk ventures istantly collapsed when the market changed (ie Robinhood restricting trades on the call options I had), which could've been avoidable if I kept my portfilio balanced.

7. Have fun!

Stock trading can be stressful, especially if you have a lot on the line. My experience with trading has been a positive experience overall, especially since I have decided beforehand that I would be okay with losing my entire balance. Trading with that mindset definitely helped take away the stress from the experience.

Options trading

I traded exclusively on stocks on Wealthsimple when I started my experiment. Later, I transferred my funds to a Questrade account so that I could start trading options. This is a good time to put in a subtle shill for my Questrade referral code 405925357448044: get $25 up to $250 cash when you open and fund any self-directed account if you initially deposit $1,000.

There are some cool guides on options trading, but in essence options are higher risk contracts that speculate on volatility. Call options let you buy a stock at a price, and put options let you sell a stock at a price. If a stock goes up sharply, I would make significantly more from a call option rather than from holding the stock. As such, options can provide a ton of profit if exercised properly, but can also bring an account to 0 (or billions in the red, case Melvin Capital). If you want to limit your risk, I'd advise against making options a significant portion of your account.

Looking back, I definitely have no regrets from putting $1k into this experiment. I learned a ton about the stock market, which I definitely would not have done, if I did put money in the game. The stock market underscores a huge potential of the free market, and reflects and catalyzes a lot of change and trends in the economy. I'd highly recommend you to explore this space if you haven't already, just don't put in more than you can lose! I'm looking forward to seeing where this trading account will go over the next year.

If you have any questions about trading, market trends, and brokerages, I'm always down to chat! Feel free to reach me at any of the handles you can find on my website. May your stocks shoot past the moon, and your pockets be blessed with countless juicy tendies!